HOTEL CMBS

You may have heard recent negative forecasts for commercial financing markets, most notably Hotel Management’s April 18th cover story “Why Lending is About to Get Tighter”. The Crittenden Report of April 11 also reported on CMBS loan underwriting fluctuations and tightening for hotels, as well as some pullback later in the year by Life Company lenders. Crittenden notes that bridge and debt fund lenders will then fill the gap that a shrinking CMBS and Life Company pool of funds for hotels creates.

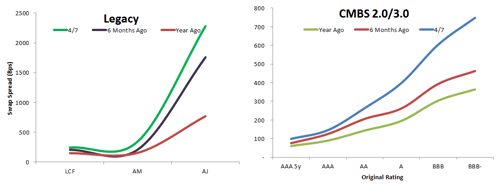

We agree that CMBS lending is getting tighter

and less attractive, and will have greater volatility this year. MBA Hotel Brokers and our Capital Markets

advisory division, MBA Capital Funding, have seen the widening spreads and

increased volatility in the CMBS lending market in 2016, resulting in higher

interest rates for borrowers. But one of the biggest concerns in the CMBS

market is how new regulations, which take effect in December, will affect the

industry. In my Jan. 20th webinar with Ann Hambly, CEO of 1st

Service Solutions, a top CMBS consulting firm to CMBS borrowers MBA recommends,

we talked about the more conservative loan terms that are already in place on

new CMBS originations. Ann said, “The lessons learned from the last cycle are

now being incorporated into the loan documents; and completely in favor of the

lender, of course”. Watch the Webinar Here. However, the major CMBS lenders are still looking for hotel

loans and CMBS is still the best loan option for some hotel assets and investor

groups that need non-recourse loans.

Bank and SBA Lending

In arranging financing for several hotel development projects and exiting hotels this quarter, we have had great success in placing financing with small local and regional banks. This lending group is often overlooked. While it can be difficult for a hotel owner or developer to canvas a dozen different small banks and even credit unions to see if they will finance a hotel, staying on top of this segment of the lending industry is one of our core knowledge areas. If you are considering a hotel purchase or refinance, don’t let the negative forecasts stop you from taking advantage of current interest rates that are still low. There are financing options available today that didn’t exist a few years ago. Small and regional banks are originating more hotel loans and the SBA 504 Green Project is an excellent, higher dollar and higher-LTV option, even for borrowers that already have SBA loans. This little known and under used program, the SBA Green Project financing, has some great advantages. We'll discuss more of what those advantages in coming BLOG posts, so stay tuned. Another use of the SBA 504 program which has not been available for a while is refinancing. At MBA Capital Funding, we are looking forward to the renewal of the SBA 504 refinance program which should be available in July or August. This program offers an attractive rate for hotels that have the cash flow, but may need an 80% to 85% LTV refinance. While the SBA loan programs require recourse, they have advantages for certain borrowers and far greater flexibility than CMBS or Life Company financing. So we have much to discuss!

If you have any questions on the lending market in general,

please comment below and I will get back to you! Or feel free to contact me

directly with questions on your particular situation. If you enjoyed this post,

please share it!

Till next time;

Charlie Fritsch